Why the increase?

In 2021-22, the TDS Insured and TDS Custodial tenancy deposit schemes in England and Wales issued 31,276 adjudications, an increase of 1,579 from the previous year.

The increase in disputes in 2021-22 is linked to the impact of Covid, with fewer tenancies ending during the lockdown period across 2020-21.

Despite the increase, disputes are being raised in only a low percentage of cases, with figures at 0.70% as of March 2022.

The main reasons for deposit disputes

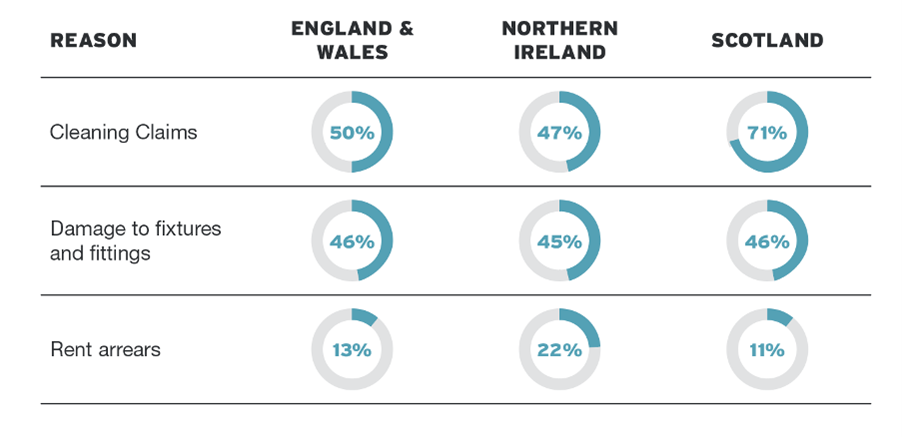

According to TDS findings, the main reasons for deposit disputes are remarkably consistent across the UK. The TDS data shows the following patterns for 2021-22 for all its schemes:

To read the TDS 2022 Statistical Briefing in full, download the free report here →

How to prevent deposit disputes

TDS has been helping agents, landlords and tenants to resolve deposit disputes for over 14 years. The TDS customer support team and adjudicators are well versed in dealing with disputes and know what to look out for to help prevent them. Here are our team’s best tips for helping to avoid deposit disputes.

- Start with the tenancy agreement. The terms of a tenancy agreement can vary from one property to the next, so having clear clauses and an understanding of who is responsible is the best way to avoid disputes in the future.

- Investing time in inventory reporting is well worth it, the more comprehensive the report is, the better! This helps to set expectations for tenants and landlords when details are captured at check-in. The condition of items detailed at the beginning and end of a tenancy is vital, so refer to the condition and cleanliness to ensure there is no ambiguity at the end of tenancy. Inventory clerks, letting agents, and landlords can benefit from Inventory Hive inventory software, a prominent inventory provider which offers an accessible solution that helps reduce deposit disputes.

- Mid tenancy inspections will give you an idea of how well the property is being maintained by the tenants and provides a good opportunity to address any concerns highlighted during the inspection, so be sure you perform them.

- Communication is key. By communicating and discussing any deposit disputes, it is possible to prevent a lot of issues from going to adjudication. Agents have found that using our Deposit Deductions template to specify the amount you want to subtract from the tenant's deposit is often successful in reaching an agreement.

- Get to know how an adjudicator thinks with CPD Certified training. The TDS Adjudication Workshop is conducted by experienced adjudicators who will detail the evidence an adjudicator looks for in a tenancy deposit dispute. Understanding what an adjudicator looks for can help resolve disputes before they reach a third-party adjudicator. Inside knowledge of what is likely to cause disputes can be utilised to produce more detailed tenancy agreements, inventories, and communications.

Not a customer of TDS yet? Discover why other agents have switched to TDS. Join today and enjoy exclusive Propertymark member discounted rates.

TDS: Easy tenancy deposit protection

Tenancy Deposit Scheme (TDS) is the only not-for-profit, Government-approved tenancy deposit protection scheme offering both FREE Custodial tenancy deposit protection and Insured tenancy deposit protection.