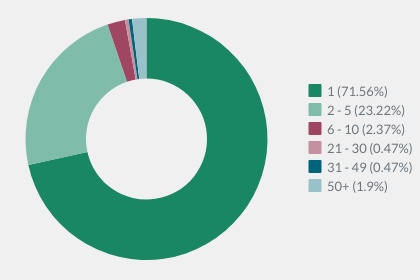

Branches per agency

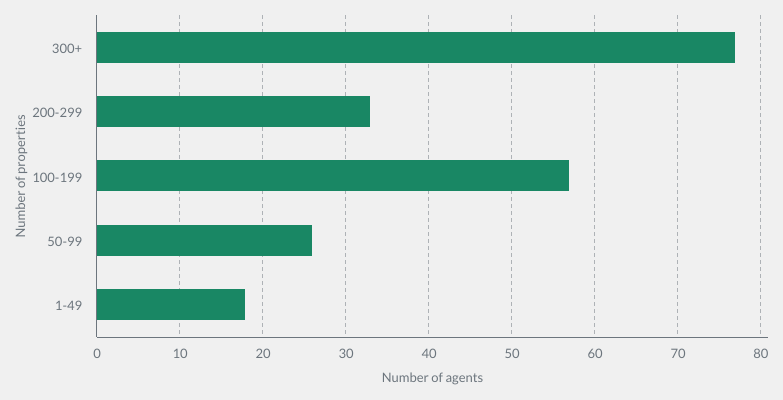

Number of properties under management

Respondents’ agencies are managing many properties with over three quarters of agencies having a portfolio of over 300 properties to manage.

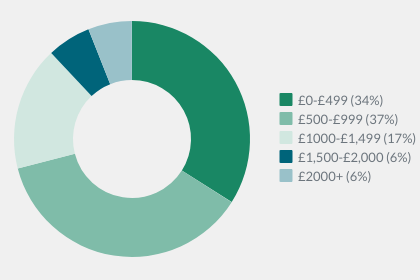

Property maintenance costs

We asked members about the type and amount of spend they witness landlords paying to maintain their rental properties in the private rented sector. Every respondent was able to provide costs for the purposes of this survey.

A good landlord will finance general maintenance work every year, in order to keep their rental properties in the required, and desired condition. Regular and recurring maintenance costs can include but are not limited to safety testing and certification, garden maintenance, decorating, heating, renovation.

Average maintenance costs

We asked members about the types of expensive alterations they have overseen and what they estimated the average cost of such works on a property to be. The majority of agents (68 per cent) said they had experienced some form expensive alteration to a rental property, beyond the regular and recurring maintenance costs.

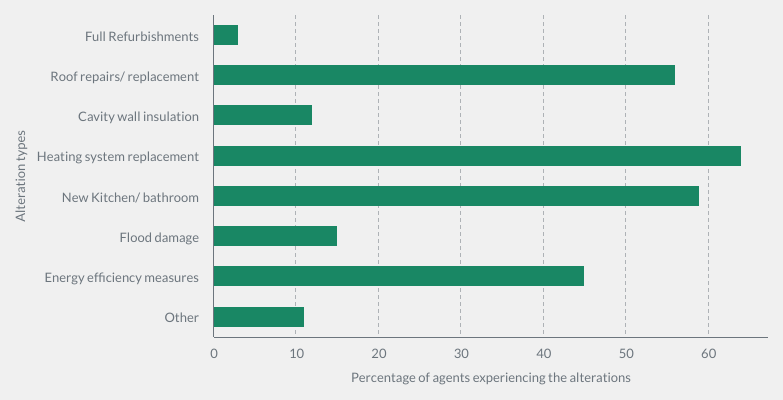

Prevalence of expensive alterations

This graph shows the types of expensive work that agents reported involvement with. The most common expensive alteration was a replacement of the heating system in a rented property (34 per cent), followed by putting in a new kitchen or bathroom (59 per cent).

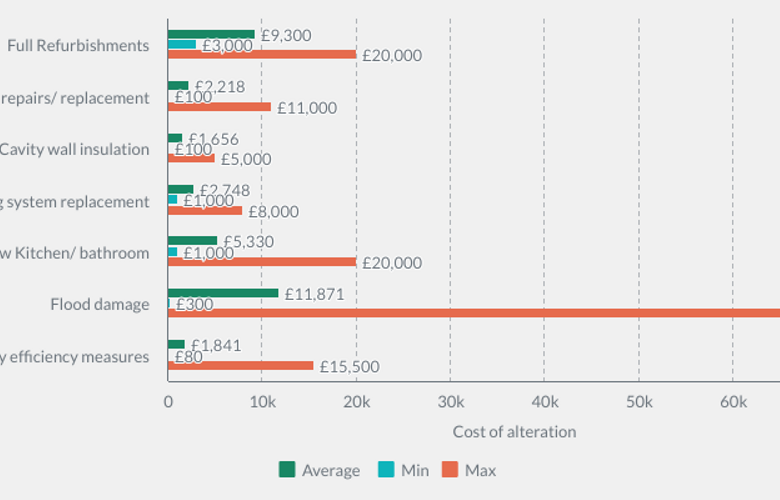

Costs associated with expensive alterations

The cost of these expensive alterations varied greatly. In particular, agents commented that repairs following flood damage could be immeasurable; and energy efficiency alterations can be as minor as changing the type of lightbulb, through to installing solar panels or a new heating system.

We also asked if there were other expensive alterations that they experience with privately rented properties. A small number of agents reported the following expensive alterations:

- Extensions and conversions

- Damp proofing

- Plumbing/leak repairs

- Dry rot

- Fire safety and electrical

- Window replacement

- Adding external cladding for insulation

The only costs they were able to provide for these alterations was an average of £3,000 for new windows and doors.

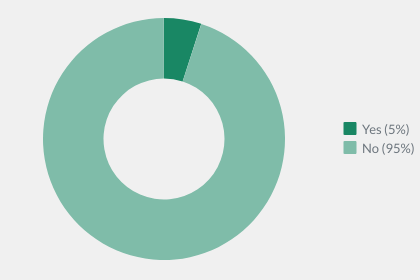

Would you support rent controls?

Rent controls could take the form of a cap on how much rent can be charged for certain properties or the introduction of rent pressure zones that limit how much existing rents can increase by.

Impact of rent controls on landlords

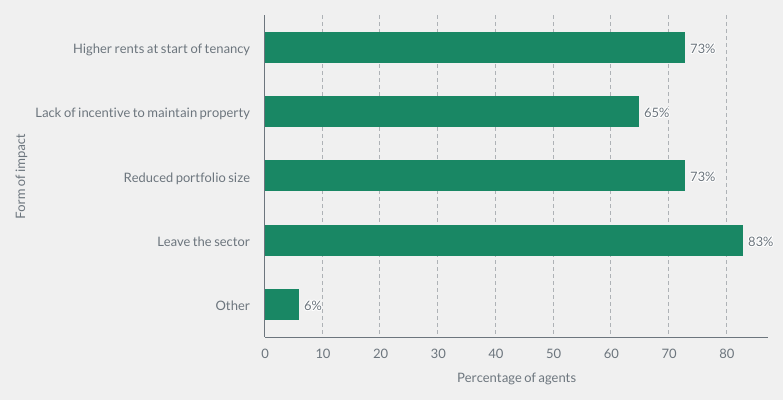

The response to this survey confirms that if rent controls were to be introduced there would undoubtedly be impacts felt across the private rented sector as a whole, with notable, detrimental impacts for landlords and letting agents.

Interestingly, of those agents who would support the introduction of rent controls, 90 per cent think it will have a negative impact for letting agents, and 80 per cent think it will have a detrimental impact on landlords.

Whilst some landlords thought the level of impact would depend on the nature of the controls and the levels of any caps enforced, others predict a mass exodus of landlords from the private rented sector as evidenced by past examples of rent controls in this country. They suggest landlords would sell their rental properties and invest their funds elsewhere.

If rents were to be capped landlords may become far more selective of potential tenants, pushing less-desirable tenants into the social housing sector or towards rogue landlords.

There was concern that some landlords would try and find other ways of making back the money from tenants, if future rent rises were capped, landlords may start tenancies on a much higher rate to compensate.

As the property maintenance responses evidence, landlords have many costs to cover in order to preserve good quality accommodation. If they are to be limited in the income they can generate from the property, the majority of agents think the quality of rental properties will deteriorate.

Impact on agents

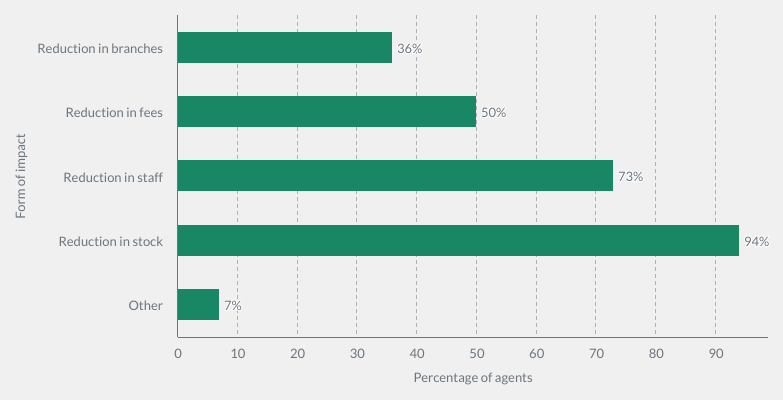

As well as having impacts for landlords, respondents also predict overwhelmingly that implementing rent controls would have a detrimental impact on lettings agencies. The graph below shows the strength of this shared belief. Although some agents predicted change would be manageable, others were less confident. One agent told us that they would “Possibly shut the door and have to close our business”.

As noted by agents in their responses to our survey, a reduction in letting agencies in the market would have a further effect for tenants. Coupled with a reduction in stock and choice in the private rented sector it would drive those looking to rent towards rogue landlords and unregulated short term let providers such as Airbnb who may be offering properties that are not fit for use as a home.

Agents not only provide a service to landlords and tenants, but they provide employment for their staff. With the prediction of a contracted private rented sector, with less stock, fewer landlords, and a smaller number of branches, evidently this would lead to a reduction in staff. Propertymark’s survey evidences this with almost three quarters of agents responding to the consultation saying they predict a reduction in staff if rent controls were to be implemented.

Geographic spread of responses received

A total of 211 consultation responses were received from across the UK.

| Region | Responses |

|---|---|

| South West | 29 |

| Hampshire, Surrey, Kent, Sussex | 42 |

| Northumberland, Cumbria, Durham, Lancashire, North Yorkshire, Isle of Man | 12 |

| Lincolnshire, Cambridgeshire, Essex, Norfolk, Suffolk | 24 |

| Merseyside, South Yorkshire, West Yorkshire, East Yorkshire, Cheshire, Derbyshire, Nottinghamshire | 10 |

| West Midlands, Staffordshire, Shropshire, Leicestershire, Herefordshire, Worcestershire, Warwickshire | 17 |

| Oxfordshire, Northamptonshire, Buckinghamshire, Berkshire, Bedfordshire, Hertfordshire | 14 |

| London | 43 |

| Wales | 7 |

| Scotland | 12 |

| Northern Ireland | 1 |

| Total | 211 |